Introduction

Public Provident Fund also known as PPF. PPF is a saving scheme introduced by the Government of India that offers tax benefits and a fixed rate of return. It is a long-term investment tool that comes with a lock-in period but promises to provide a stable and secure return. To put it simply, PPF is a saving avenue for individuals looking for guaranteed returns on their investment.

Any Indian resident can open a PPF account and contribute to it on a yearly basis. The investment has a 15-year lock-in period, which means that the invested amount is safe and grows with interest for 15 years. So, want to ensure a hassle-free and secure future? PPF is a good way to make it happen.

PPF has become increasingly popular among investors due to its tax-saving benefits, guaranteed returns, and low risk. It not only helps you inculcate a habit of saving but also offers a steady return to help you reach your financial goals. So, if you’re looking for low-risk and assured returns, PPF is the way to go.

Eligibility and Account Opening

What is the Public Provident Fund (PPF)? Public Provident Fund (PPF) is a government-backed savings scheme that offers a fixed rate of return to investors. It was introduced to encourage individuals to save for their retirement and build a corpus for the long term. The PPF scheme is known for its safety, returns as well as tax benefits, which make it a popular investment option in India. How does PPF work? PPF is a long-term investment option with a duration of 15 years, which can be extended for 5 years after maturity.

One can open a PPF account with any authorized nationalized bank, authorized private banks, authorized post offices, and the State Bank of India (SBI). An individual can open only one PPF account in their name. Who can open a PPF account? The PPF account can be opened by Indian residents, including salaried individuals, self-employed professionals, and those with irregular sources of income. Parents/guardians can open a PPF account for minors too.

Non-resident Indians (NRIs) are not eligible to open a PPF account, but those who had opened an account before becoming an NRI can continue to hold the account until it matures. Where can one open a PPF account? PPF accounts can be opened at authorized nationalized banks, authorized private banks, authorized post offices, and the State Bank of India (SBI). It is a hassle-free process and can be opened with a minimum deposit of Rs. 100.

What are the documents required? To open a PPF account, an individual needs to submit an account opening form along with identity proof, address proof, and a passport-sized photograph. The documents required include PAN card, Aadhaar card, passport, driving license, and voter ID card, among others. If you’re looking for a safe and long-term investment option with tax benefits, PPF is an excellent choice. With a minimum deposit requirement of just Rs. 100, opening a PPF account is easy, and the returns are guaranteed too.

Features and Benefits

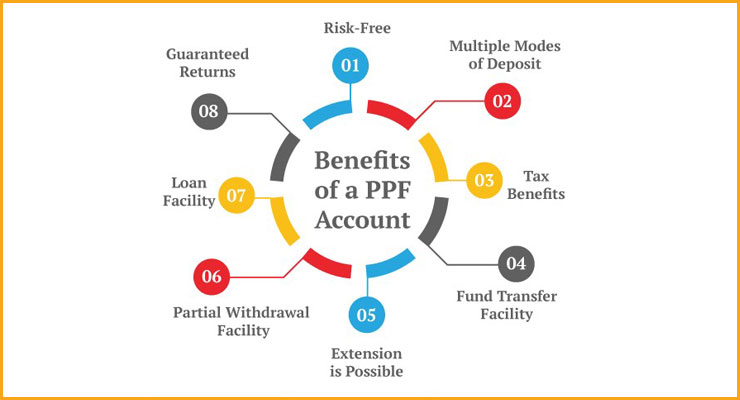

After addressing eligibility and account opening, let’s dive into the key features and benefits of the Public Provident Fund (PPF). Interest Rate and Tax Benefits: One of the major attractions of PPF is the guaranteed and tax-free return it offers. Currently, the interest rate is fixed at 7.1% per annum, which is compounded annually. The interest income earned on PPF investments is exempt from tax, making it an excellent tax-saving investment option.

Duration of the PPF account: The minimum duration of a PPF account is 15 years, which can be extended in blocks of 5 years. This means that even after maturity, you can keep your account active and continue to earn interest on your investments. The long-term nature of PPF makes it an excellent retirement planning tool. Loan and Withdrawal Facility: PPF allows partial withdrawals after the completion of the 6th year of the account.

You can withdraw up to 50% of the balance in your PPF account as of the end of the 4th year, or the balance at the end of the preceding year, whichever is lower. Also, you can avail a loan against your PPF account between the 3rd to 6th year from the account opening year. The interest rate on the loan is 2% higher than the PPF interest rate. Nomination Facility: It’s always prudent to have a nomination for all investments. In the case of PPF, you can nominate up to two people to receive the funds in case of your unfortunate demise.

Nomination can be done at the time of opening the account or at any time during the tenure of the account. Apart from the above features, another significant benefit of PPF is its flexibility in terms of contribution. You can choose to invest as little as Rs. 500 per year and up to a maximum of Rs. 1.5 lakhs per year. The contributions can be made in one lump sum or in instalments not exceeding 12 in a year. When you compare PPF with other investment options, it scores high on many fronts.

Unlike bank fixed deposits, PPF offers tax-free returns. Compared to other fixed-income investment options like the National Savings Certificate (NSC), PPF has a lower lock-in period, can be extended indefinitely and offers multiple withdrawal options. The equity-linked savings scheme (ELSS), on the other hand, is subject to market risks and volatility, which is not the case with PPF. In conclusion, PPF is an excellent investment option that provides guaranteed returns, tax benefits, and is ideal for long-term savings. When opening a PPF account, it’s vital to understand the features and benefits and make the most of its flexibility to maximize returns.

Contribution to PPF

You’ve probably heard of Public Provident Fund or PPF. It’s a popular retirement savings scheme offered by the Indian government. As we know, PPF offers tax benefits and interest on the deposits made for a fixed term of 15 years. So, let’s dive into the contribution part of the PPF account. When you open a PPF account, you will need to contribute a minimum of Rs.500 to keep the account active. The maximum amount you can deposit is Rs.1.5 lakh per year.

This amount can be deposited in a lump sum or in a maximum of 12 installments per year. The minimum contribution amount seems relatively low, but even the smallest contribution can make a meaningful difference over time. PPF is more of a long-term investment, so you should contribute regularly to maximize the benefits. What about late deposits? If you miss depositing the minimum Rs.500 in any given year, you will have to pay a penalty of Rs.50 along with the deposit amount for that year.

An important thing to remember is that if you don’t contribute for a year, the account becomes inactive. You can reactivate the account by paying Rs.500 for each year of inactivity along with the penalty charges. So, it’s crucial to keep the minimum amount deposit and avoid missing the contribution in the PPF account. Frequent misses or inactivity can harm the account in the long run, which can affect the corpus. Overall, PPF is a popular investment option that offers decent returns and tax benefits. Keep contributing regularly to reap the maximum benefits.

PPF vs other investment options

Once you enter the investment market, the first thing that comes to your mind is where and how to invest. With the abundance of options available in the market, it can be a little confusing to pick the right one. Two popular investment vehicles are the Public Provident Fund (PPF) and Fixed Deposits (FDs). When it comes to comparing PPF and FDs, PPF has a lock-in period of 15 years, whereas for FDs, it depends on the tenure chosen.

PPF investments are tax-free, whereas FD interest is taxable. In terms of interest rates, PPF is more lucrative, offering an interest rate of 7.10% in current times, while FDs are offering lower interest rates at 5.50% to 6.25%. Another popular investment option is the National Savings Certificate (NSC). While FDs offer flexibility in terms of choosing the tenure, NSCs have a fixed tenure of 5 and 10 years. The NSC rate of interest for the July-September quarter is 5.9%.

Comparatively, PPF provides a slightly higher interest rate. Lastly, when it comes to comparing PPF to the Equity-Linked Savings Scheme (ELSS), which is a mutual fund, they are entirely different investment instruments. ELSS invests in equity shares and has the potential to provide much higher returns than PPF. However, they are also exposed to market risks. PPF, on the other hand, is considered as a secure long-term investment option. In a nutshell, each investment option has its pros and cons.

PPF offers tax-free guaranteed returns over a long period, while FDs and NSC offer fixed returns over a shorter period. ELSS offers the potential for higher returns but also comes with a higher risk. It is important to identify your financial goals and choose an investment option accordingly.

Tips to maximize returns from PPF

When it comes to maximizing returns from a PPF account, there are a few things you can do to ensure you’re making the most of this investment option. Firstly, contribute the maximum amount every year – this will help you earn more interest and grow your wealth faster.

Timing of deposit is also important – try to deposit the full amount at the beginning of the financial year to earn interest on the full amount for the entire year. Finally, consider extending the duration of the account – a 5-year extension can allow you to earn interest for another 5 years and provide a higher yield. Remember, PPF may not be the most glamorous investment option, but it’s a reliable and safe way to save and grow your money over the long term.

By following these simple tips, you can get the most out of your investment and secure your financial future.

Conclusion

To sum up, PPF is an attractive long-term investment option for those seeking steady returns and tax benefits. Eligibility criteria are minimal, and account opening is a hassle-free process. PPF offers flexibility and liquidity with premature withdrawal and loan options.

Make regular contributions and extend the 15-year duration to maximize returns. PPF emerges as a more lucrative option than other investments such as FDs, NSCs, and ELSSs suitable for an average investor’s preference.

Disclaimer: The views expressed in this blog are for educational purposes only. This is not professional advice. Consult your financial advisor before investing.