If I ask you, what is common between Honeywell Automation, ABB Limited, Sales Global, and Bharat Electronics? Well, apart from being top engineering companies, they have one common partner in the electronics manufacturing sector. It’s CYIENT DLM, a subsidiary of CYIENT Limited, which is a leading engineering service provider with over three decades of domain expertise and a big multibagger company with eight times return in the last 10 years.

Introduction

CYIENT Limited has launched the IPO of its subsidiary, CYIENT DLM, which is a leading electronics manufacturer. Well, it is not a hidden fact that the electronic sector in India is still in its nascent stages and poised to grow at a very fast rate.

Now, personally, when I look at an IPO, I don’t just invest for listing gain. I always look for long-term multibagger potential. And like I said in my previous analysis of Idea Forge, it’s not just relying on an IPO lottery, but more about identifying fundamentally strong companies with leadership in the sunrise sector so that you can keep them in your watchlist and invest systematically post-IPO. And CYIENT DLM looks like one such fundamentally strong company with huge return potential in the next five to ten years. So in this article, we’ll understand its business model, leadership, future growth prospects, key risks, and IPO details along with valuation.

CYIENT DLM was incorporated 30 years ago in 1993 as an electronics manufacturing company, and today it is a leading EMS (Electronics Manufacturing Service) provider with a focus on the entire lifecycle of a product, including its design, build, and maintenance.

It is a dominant player in the LVHM (Low Volume High Mix) category. That stands for low volume high mix. So, one of the segmentations in electronics manufacturing is HVLM and LVHM. Basically, HVLM stands for high volume low mix, where a few types of assemblies are produced in large quantities.

It includes the manufacturing of consumer electronics like TVs, washing machines, fridges, etc., as well as mobile phones, computers, laptops, etc. Examples of companies in the HVLM segment include Dixon and Amber. On the other hand, LVHM stands for low volume high mix. It has a high emphasis on quality and customization that changes according to customer requirements. So, LVHM has low volume but higher margins, as clients prefer to pay higher prices without compromising on quality.

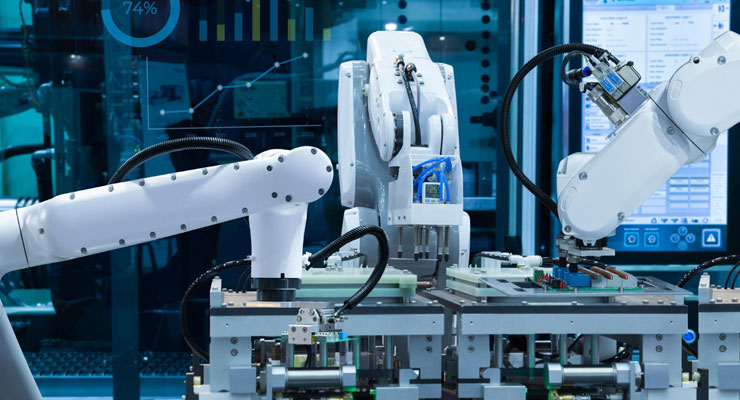

It includes electronics manufacturing in the aerospace sector, medical equipment, defence sector, and so on. And CYIENT DLM falls into this LVHM category, and this is the reason its clients include the likes of Honeywell Auto and the American government, which is a leading automation and software solutions company in the world, ABB, a Switzerland-based company that is again a pioneer in robotics, machine automation, and digital services, and Thales Global, a French MNC that specializes in engineering for aerospace, defence, transportation, and security sectors.

I mean, these companies are world leaders in the advanced engineering space, and their clients of CYIENT DLM with an average relationship of 11 years.

Verticals

Now, CYIENT provides its services in two forms: B2P (Built to Print) and B2S (Built to Service). In B2P, the client would provide the design for the product, and CYIENT DLM would manufacture the product. In B2S, CYIENT DLM would provide both design and manufacturing. Its solutions include printed circuit board assembly which is the heart of an electronic device where multiple components are assembled.

It also includes cable harnesses used for transferring signals or electrical power, and the third is the build box. The build box is the final product where the OEMs (Original Equipment Manufacturers) put their logo. For instance, if CYIENT DLM is manufacturing a medical diagnostic equipment for Honeywell Auto, once the product is ready, Honeywell will put its logo and sell it. Within the build box, CYIENT DLM builds electronic components like cockpits, in-flight systems, landing systems, and medical diagnostic equipment.

Manufacturing Facilities

CYIENT DLM has three manufacturing facilities in Mysore, Hyderabad, and Bangalore. The Mysore facility is 65,900 square feet and is engaged in aerospace and defense manufacturing. The Hyderabad facility is 1.5 lakh square feet and is engaged in medical and healthcare technology. The Bangalore facility is 12,200 square feet and is engaged in high-precision manufacturing. In total, it has an area of 2.29 lakh square feet.

Financials

If we look at the company’s financials, its revenues have grown from 628 crore in FY21 to 720 crore and now at 832 crore. Please note that these numbers are in millions. The revenue growth has been average in the last two to three years.

The company operates with a gross margin of 15% and an EBITDA margin of 10.55%. In FY13, the EBITDA margin improved from 7.3% to 21%. Please note that while the EBITDA margins may appear lower, this is common in all electronics companies.

In fact, company’s EBITDA margins are just 4%. The EBITDA in FY21 was 45 crore, which increased to 84 crore and now stands at 87 crore. Net profits have grown from 11 crore to 39 crore and fell down to 31 crore in FY23. The company is consistently generating free cash flow of 7 crore, 40 crore, and 44 crore respectively, and it has a total cash balance of 167 crore as of FY23.

Its Return on Capital (ROC) in FY21 was 11.48%, which increased to 17.5% and now stands at 13.4%. Currently, the company has net borrowing of 314 crore against equity of 197 crore. So the debt-to-equity ratio is 1.6, but please note that the company has a cash balance of 167 crore. Hence, the net debt-to-equity is 0.7, and this will further reduce as the company plans to utilize 160 crore rupees from the IPO for repayment of its borrowings.

Overall, the revenue growth has been average so far, and profitability is also average. But the key here is the order book. It has an order book of 2,432 crore as of March 2023. This order book has grown exponentially from 99.6 crore in FY21 to 1,202 crore and now at 2,432 crore.

Please note that its revenue for FY23 was 832 crore, so the current order book is three times its revenue, which suggests good growth in the future. Moreover, the company has a very low capacity utilization. Measured capacity utilization is just 38%, whereas its Hyderabad capacity, which is the largest capacity, has just 7.6% capacity utilization in FY23 as it is a new setup and full-fledged production is yet to start. So going forward, as the capacity utilization improves, profitability will also improve.

Revenue Breakup

If we look at the revenue breakup by FY23, 20% of the contribution is from the aerospace sector, 38% from defense, 16% from medical, and 25% from the industrial division. In terms of revenue breakup by products, 63% of revenue comes from printed circuit board assembly (PCBA), 1% from cable harnesses, and 32% from build box.

Leadership

On the leadership side, CYIENT DLM has a very strong promoter pedigree of CYIENT Limited, which is a leading technology solutions company with three decades of experience and a great wealth creator for its shareholders. CYIENT DLM also has a strong leadership team, including Anthony Montalbano as CEO, responsible for providing strategic direction to the company, and Rajendra Velikapudi as the MD, responsible for manufacturing operations. The company also has a strong board of directors.

Future Growth Prospects

Now let’s move on to the future growth prospects of CYIENT DLM. Some of the biggest trends in the 21st century include electric vehicles, artificial intelligence, high-speed internet, and the Internet of Things. All these emerging technologies have one thing in common: they need semiconductor chips. If the future of the world is digital, then the electronic sector is the backbone of this revolution.

Specifically, in the sectors where CYIENT DLM is focused, aerospace and defense are expected to be driven by smart factories, improving efficiencies, and defence contracts, including advanced military capabilities. In the medical sector, IoT, wireless, and artificial intelligence will play a crucial role, leading to the growth of the EMS industry.

Similarly, in industrial electronics, the focus is on automation and robotics, where the EMS industry will also play a significant role. The Indian EMS industry is the fastest-growing among all countries, and one of the biggest drivers of growth is global MNCs trying to reduce dependency on China, with India emerging as a great alternative.

Additionally, the Indian government is highly focused on electronics manufacturing. It is already a part of the PLI (Production Linked Incentive) scheme, and recently, the Indian government announced $10 billion of incentives to create a semiconductor ecosystem in the country. With a population of 1.4 billion, there is significant demand for consumption, further contributing to the growth potential of the EMS sector in India.

In terms of CYIENT DLM’s competitive advantage, electronics manufacturing itself is a complicated business that requires highly specialized knowledge to enter the sector. Additionally, CYIENT DLM operates in the LVHM segment, focusing on low volume and high mix products for the aerospace, defense, and medical equipment industries.

Clients in these industries do not switch partners frequently due to stringent quality and qualification requirements. Furthermore, CYIENT DLM not only has manufacturing capabilities but also design capabilities, providing end-to-end manufacturing services. It also benefits from its strong parentage of CYIENT Limited.

Key Risks

Regarding key risks, please note that the original question was cut off and I couldn’t access the rest of the content. If you have any specific questions or need further information, please let me know.

Disclaimer: The views expressed in this blog are for educational purposes only. This is not professional advice. Consult your financial advisor before investing.