Introduction

ChatGPT has emerged as a big threat to the entire existence of Google. But guess what? Google is always one step ahead of its competitors when it comes to innovation. In the case of AI-based chatbots, Google is again not far behind. Right after a few months of the launch of ChatGPT, Google has launched its own AI-based chatbot named Bard.

The world around us is changing really fast with continuous innovation and technology. Personal computers, laptops, internet, Wi-Fi, and smartphones have literally disrupted our way of living. The latest disruption in the world of technology is artificial intelligence.

So, I had a look at Google bot and its features, with a special use case in the world of personal finance and investment. Having a tech background myself, I love to explore technology that makes our life easier, and it looks like these AI chatbots, like ChatGPT and Google Bard, are really game-changers in the world of investment and personal finance.

I’ve almost stopped using Google Search. Now, I’m using ChatGPT to get answers to all my queries. But it looks like Google Bard is one step ahead of ChatGPT. Yes, you heard it right! After the initial usage of Google Bard, I compared it with ChatGPT and found one important feature that makes Google Bard even better than ChatGPT, especially in the field of finance and investment.

How is Google Bard different?

In this article, we will look at how to use Google Bard and compare its results with ChatGPT. This will help you understand how you can also use them in your day-to-day life and what makes Google Bard different from ChatGPT.

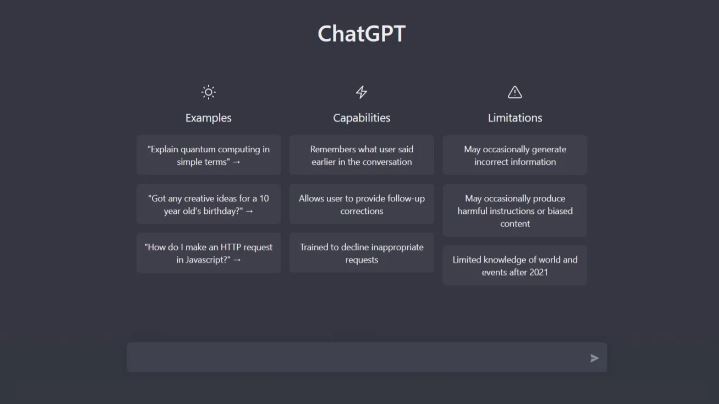

So, if you want to open Google Bard chatbot, you just need to search “Google Bard” and you’ll get the first link. This is how the user interface (UI) will look like. It is similar to ChatGPT UI, where you have the “Send a message” section.

Now, let’s take a few examples to really understand how Google Bard is different. First of all, please be very clear that you need to identify queries and use cases that you cannot find on Google Search. Because if you simply want to know something like “What is Sensex?” or “What is PE ratio?”, you can easily Google it and get the answer. So, you want to know something that you cannot easily find on Google Search but can find on Google Bard and ChatGPT. This is what we are trying to do.

Compare Google Bard vs ChatGPT

Let’s say you want to know more about valuation analysis. You want to understand how to do valuation analysis. Let’s search, “I want to know more about valuation analysis. Can you please elaborate?”

This is the response from Google Bard: “Valuation analysis is the process of determining the value of an asset. It discusses some of the ratios that include discounted cash flow, comparable companies earning, asset-based valuation, and more. The value of an asset can be affected by a number of factors including future cash flow, risk of the asset, asset liquidity, future potential, industry, economic environment, and so on. Valuation analysis is an important tool for investors, lenders, and other stakeholders. It provides examples of how valuation analysis can be used, such as determining the value of a business before it goes public or takes a loan, and how investors might use it before investing their money.”

This is a generic response, as the query was also generic. If you want a specific response, you need to ask a specific query. Now, let’s see what the response from ChatGPT would be.

ChatGPT replies: “Valuation analysis is a process of estimating the worth of a company. It is typically used by investors, analysts, and other financial professionals to determine the value of an investment opportunity or to make an investment decision. It discusses common valuation methods, including comparable company analysis, discounted cash flow, asset-based valuation, economic value added, and other methods. The choice of valuation method depends on the nature of the asset being valued, the purpose of valuation, and the availability of data.”

Let’s try another query and ask ChatGPT to see how it replies. Let’s say, “I want to invest in the stock market. Can you please help me with how to do valuation analysis?” Here is the response from Google Bard:

Google Bard replies: “First step, do your research. This means you need to understand the company’s financial statements, read analyst reports, and follow the company’s news. Then, use valuation models. It doesn’t mention specific models to use. Companies’ valuations with its peers can help make a decision. This is a generic response.”

Now, let’s see what the response from ChatGPT would be. We’ll copy and paste the same question and see how it replies.

ChatGPT replies: “I would be happy to provide some guidance on how to conduct a valuation analysis. It suggests choosing a valuation method, gathering financial data like balance sheets and cash flow statements, identifying comparable companies, calculating financial ratios such as price-to-earnings, price-to-sales, price-to-book, return on equity, and more. Then, it says to compare the ratios and finalize the valuation.”

Based on the analysis I have done so far, I found ChatGPT a bit more elaborative and intelligent in its responses. Now, let’s dig deeper and ask, “Can you please help me with the key ratios for valuation analysis in stock investment?”

Here is the response from Google Bard: It mentions various ratios like price-to-earnings, price-to-book, price-to-sales, return on equity, return on assets, debt-to-equity, earnings growth rate, and provides some explanation for each ratio.

If we copy the same query to ChatGPT, here is its response: It provides a similar list of key ratios like price-to-earnings, price-to-book, return on equity, debt-to-equity, dividend yield, and more. It also provides some explanation for each ratio.

Overall, if you look at the response, based on the analysis I have done, I found ChatGPT’s response slightly more elaborative.

Now, let’s say you want to know the price-to-earnings ratio (P/E ratio) in detail. Please explain the P/E ratio with an example. Here is the response from Google Bard: It explains that the P/E ratio is a valuation ratio that compares a stock price to its earnings. It provides an example where a company’s stock price is Rs.100 and EPS is 2. So, the company’s P/E ratio would be 50. It means investors are willing to pay Rs.50 for every Rs.1 of earnings that the company generates. It further elaborates on this concept.

Now, let’s see how ChatGPT replies. It says, “Sure, I would be happy to explain the P/E ratio. It is a popular valuation metric to determine whether a stock is overvalued, undervalued, or fairly valued. It gives a similar example of a stock price of Rs.50 and EPS of 5. The calculated P/E ratio is 10, which means investors are willing to pay Rs.10 for every Rs.1 of earnings. It provides a more specific response. A high P/E ratio might indicate that a stock is overvalued, and a low P/E ratio may suggest that a stock is undervalued.”

If you compare the responses, they are similar, but I found ChatGPT’s response slightly more elaborative. It explains the calculation of the P/E ratio and provides a clearer explanation of what a high or low P/E ratio may indicate.

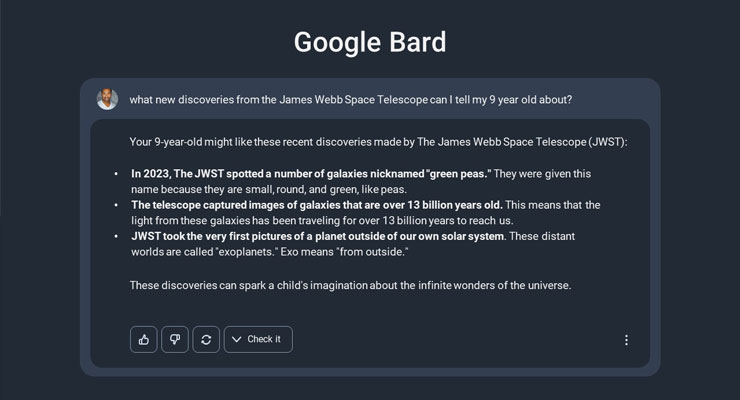

Now, let’s move on to specific use cases and how you can use Google Bard. Let’s say you want to know why ICICI Direct is bullish on KPIT.

If you search, “Why is ICICI Direct bullish on KPIT?” Here is the response from Google Bard: It mentions that ICICI Direct is bullish on KPIT for the following reasons: the company is well positioned to benefit from the growth in automotive and technology services, KPIT has a strong track record, the company is investing in new technologies such as electric vehicles and autonomous driving, and it is trading at a reasonable valuation. It provides a summary of the reasons.

Now, let’s see what ChatGPT replies. We’ll copy the same query and check its response. ChatGPT replies with a similar response, mentioning that ICICI Direct is bullish on KPIT due to factors such as the company’s potential in the automotive and technology services sector, its strong track record, and its reasonable valuation. It provides a slightly different explanation but conveys the same idea.

Conclusion

These are just a few examples of how you can use Google Bard. You can search for information about specific companies, their business models, leadership, growth drivers, market cap, P/E ratio, and more. It provides a wide range of information that is relevant to the field of personal finance and investment.

One major advantage of Google Bard over ChatGPT is that Google Bard’s information is the latest and up to date as of today’s date. In contrast, ChatGPT’s information is only available until November 2021. In the field of finance and investment, staying updated with the latest information is crucial, and that is what makes Google Bard more advantageous.

Please note that both Google Bard and ChatGPT may sometimes provide wrong or inaccurate information, so it’s important to cross-verify the information from reliable sources. However, these AI-based chatbots are constantly evolving, and they have the potential to provide valuable insights and assistance in various domains, including personal finance and investment.

I hope you found this information useful. If you have any experiences or thoughts about Google Bard and ChatGPT, please share them in the comments. And if you found this article helpful, please share it with your friends and colleagues. Thank you.

Disclaimer: The views expressed in this blog are for educational purposes only. This is not professional advice. Consult your financial advisor before investing.