Introduction

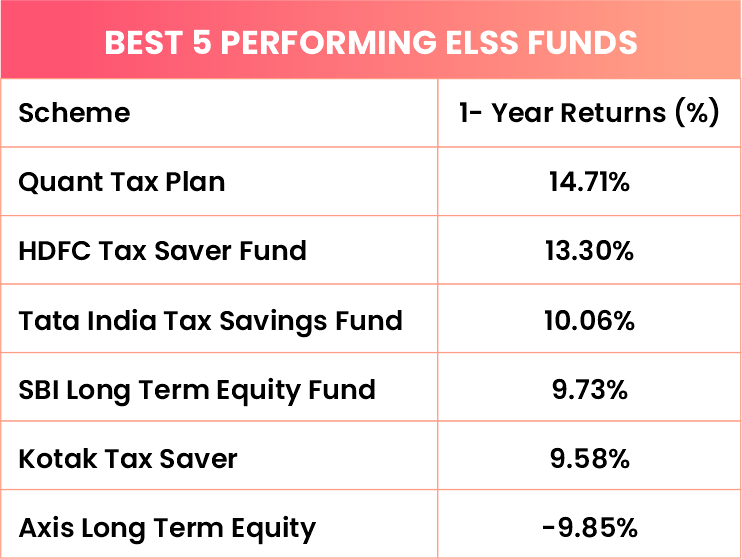

Axis long-term Equity is the country’s largest tax-saving fund. The fund has over 31,000 crore in assets under management. Investors love it, which is why it has grown this big. You can judge its popularity by looking at the fund size of the second and third largest funds. However, many existing investors of Axis Long-Term Equity Fund would be unhappy at present. That’s because it’s the worst performing tax-saving fund in the last one year. It’s not just the worst performer, the returns are minus 10 percent when other funds are in the green. This can even be scary for some investors. But what led to such a performance? In this blog, we will discuss four things:

- The history and past performance of Axis Long-Term Equity Fund.

- How the fund manager operates this fund.

- Reasons behind its underperformance.

- Finally, we will address the most important question that many of you may have: Should you stay invested in the fund, or is it time to exit?

Let’s begin.

Axis Long-Term Equity Fund may have disappointed investors in the past one year, but if we look at the long-term returns, Axis Long-Term Equity Fund continues to outperform its benchmark. If you have been an investor in the fund for seven years, your returns might be good despite the last one year of underperformance.

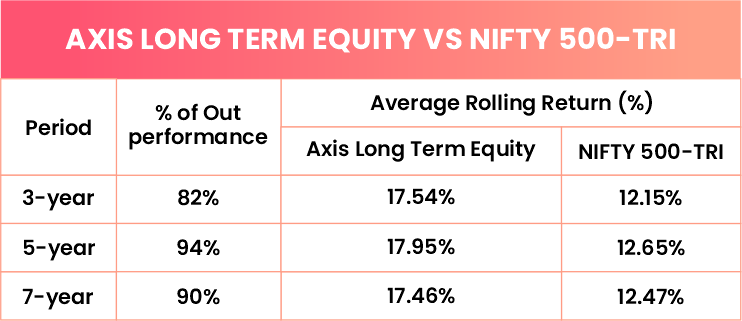

Let’s look at some data to understand this. We looked at the fund’s rolling returns for 3, 5, and 7 years. Rolling returns help to know how consistently a fund has performed.

The Outperformance

The fund has outperformed its benchmark 82 percent of the time in the three-year period. This is an impressive short-term performance. In fact, the performance is even better if you look at the long-term horizon. In a five-year period, the fund outperformed the benchmark 94 percent of the time.

The outperformance was 90 percent if you take a seven-year period. Also, the average returns of the fund have been far ahead of the benchmark. The average returns for the fund have been consistently over 17 percent. They are far higher than the benchmark. What does the data tell you? It means that most investors have been able to get better returns than the benchmark. It also indicates that the track record of the fund is pretty impressive.

Now comparing the fund to its benchmark is one way to evaluate its performance. We also need to check how the fund has performed compared to other tax-saving funds. Now let’s see that. On one side, we looked at the quarterly performance of the fund. On the other side, we looked at the quarterly performance of the entire ELSS category.

Comparison with ELSS Category

Then we compared the two. Axis Long-Term Equity Fund has done better than the category on most occasions. The fund has outperformed its peers in 36 out of 50 quarters. In fact, the data shows one more impressive thing: Axis Long-Term Equity Fund offers better downside protection compared to other tax-saving funds. As you can see in the table, since this fund’s inception, the ELSS category was in the red in 18 quarters. The fund fell in less than 12 of them. So the downside protection also shows that the fund has an excellent long-term track record.

Now, before we move further, let’s spend a few minutes on the fund’s downside protection. After all, a good fund is one that protects its returns when the market slides. As we said, Axis Long-Term Equity Fund has done better than most tax-saving funds. It has been able to do so by investing primarily in large-cap stocks. Axis Long-Term Equity Fund has a 79 percent exposure to large caps.

The average allocation of the ELSS category is 69 percent. Since large-cap stocks are less volatile than mid and small caps and usually register lower falls during market downturns, you get a reasonably stable portfolio with this approach.

Now investing mainly in large caps is one thing this fund does, but there’s a lot more it does to deliver the outperformance we discussed earlier. So now let’s look at that.

Fund Manager Capabilities

The performance of most diversified equity funds comes from three things:

- Fund manager and investment team’s ability to spot undervalued businesses.

- Buy them at the right price.

- Hold them with conviction.

Now, Axis Long-Term Equity Fund’s manager is Jinesh Gopani, who has been managing this fund for over a decade. A fund manager being around for this long gives the scheme stability. Gopani and his team are efficient stock pickers. Their portfolio and performance show that they look for unique ideas, and once they find such ideas, they show high conviction in them and hold them for the long term. How long? Well, he has held some of the stocks for over a decade. For example, Gopani has had HDFC Limited and HDFC Bank in the portfolio since the fund was launched.

The data clearly shows that the fund manager follows a buy and hold strategy. This buy and hold strategy is also reflected in the fund’s turnover ratio. The fund has one of the lowest turnover ratios in the ELSS category. The average turnover ratio for the category is 45. For Axis Long-Term Equity Fund, it’s 17. The turnover ratio tells us how much buying and selling the fund manager has done in the past one year. A turnover ratio of 100 means that the fund manager has churned the entire portfolio.

Now let’s look at how the oldest stocks in the portfolio have performed. As you can see on the screen, some stocks like Astral and Bajaj Finance have been multi-baggers for the fund. Others like HDFC Bank and Kotak Mahindra Bank have given stellar returns. When these stocks do well, the fund outperforms.

Reason for Underperformance

The reasons for the recent underperformance are the same. Some stocks that the fund holds have not done well recently. Some of the top holdings of the fund have not done well in the past year. Stocks like Info Edge, TCS, Avenue Supermarts are down by 15-20% and are lower than its stock price a year ago.

We looked at the reasons for the current underperformance. Now, the key question: If you are an investor in this fund, should you continue to hold it? Nobody would like to see their investments underperform. It’s natural for investors to be concerned. So, what should you do if you are an investor in Axis Long-Term Equity Fund?

Conclusion

Now, data shows that the fund has a terrific track record. Some of its stocks have not done well recently, which is why the fund is underperforming. But it is natural for all funds. Every fund goes through periods of underperformance. No actively managed fund has consistently delivered returns year after year. At the same time, no one knows if the fund will regain its past glory. Whenever you invest in an active fund with a track record, give the fund manager some time. If any fund underperforms for one year, put it on your watch list. We believe you should exit a fund only if it underperforms for two years. So, you can continue with your SIPs.

Now, what should you do if you are evaluating tax-saving funds to make new investments? Axis Long-Term Equity Fund is still a good bet going by its historical performance. But if the recent underperformance is a cause for worry, you can look at other schemes with a long-term track record. Evaluate a tax-saving fund with at least five years of history.

Please share your views in the comment box below and please share with your friends and family if you like my content.