Introduction

Today, I want to discuss a possible multi-bagger stock in the fine and specialty chemical space. This stock has a market cap of around 1850 crore, making it a micro-cap company. The stock’s name is Yasho Industries. We’ll examine its business model, leadership, future growth prospects, and risks, and then analyze its valuation.

Incorporated in 1985, Yasho Industries is primarily engaged in the business of specialty and fine chemicals. It has been nearly 38 years since the company’s inception, and it manufactures 148 products across five business verticals: food antioxidants, aroma chemicals, rubber chemicals, lubricant additives, and specialty chemicals.

Let’s delve into the business divisions in detail. Firstly, the food antioxidant segment offers five products that are used to keep food fresh and appetizing for a longer time while enhancing its nutrient content. The end applications include edible oils, confectionaries, food, animal feed, nutraceuticals, and more.

Secondly, the aroma chemical segment comprises 13 products, including fatty esters, natural and essential aroma oils used in personal care products like toiletries, cosmetics, oral care products such as toothpaste, tooth powder, mouthwash, flavors and fragrances, agrochemicals, and pharmaceutical products like pain relief, cold and cough formulations. It’s important to note that Yasho Industries is a market leader in clove oil and its derivatives.

The third segment is rubber chemicals, offering 87 products used in the manufacturing of tires, automotive components, conveyor belts, surgical gloves, condoms, and balloons.

The fourth segment is lubricant additives, which includes 22 products used in hydraulic turbines, engines, and other applications.

Finally, the specialty chemical segment encompasses 21 products with multiple areas of application, including stabilizers for acrylates, printing and coating, UPR resins and fiber composite resins, cross-linkers for thermoplastics, electroplating chemicals, intermediates for APIs, bulk drugs, and agrochemicals.

Revenue Breakdown

If we look at the revenue breakdown in FY22, aroma chemicals contributed 14% to the total revenue, food antioxidants contributed 13%, rubber chemicals had the highest contribution with 35% revenue share, lubricant additives contributed 14%, and specialty chemicals contributed 25%. It’s worth noting that among these segments, aroma chemicals and food antioxidants are highly competitive, which is why the company is focusing on the remaining three segments: rubber, lubricant, and specialty chemicals. The revenue share from these segments has been growing over time.

In terms of geographical breakdown in FY22, 36% of the revenue came from India, 27% from the US, 22% from Europe, and 15% from the rest of the world. The company has a well-diversified business across the globe. Currently, Yasho Industries operates three manufacturing sites in Vapi, Gujarat, with a total capacity of 11,000 metric tons.

The company has reached over 50 countries and has more than 2,000 clients, including renowned names such as Apollo Tires, MRF, Michelin, Continental AG, Colgate-Palmolive, Dabur, Indian Oil, Adani Wilmar, HP, and many more. This prestigious client list signifies the reputation of Yasho Industries in its domain.

Financials

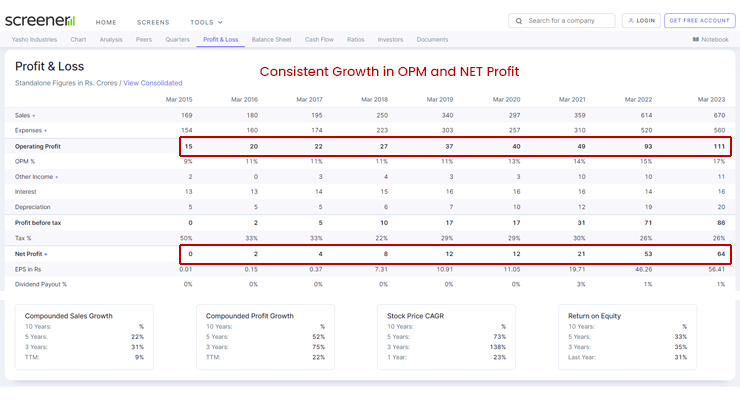

Now, let’s examine the company’s financials. The revenues have grown consistently over the years, from 169 crore in 2015 to 670 crore in FY23. Interestingly, the margins have also consistently improved from 9% to 17% in the latest financial year. The main reasons for this margin expansion are the higher contribution from specialty chemicals, rubber chemicals, and lubricant additives, which are high-margin businesses. These three segments are expected to be the key growth drivers for the company going forward.

Due to the margin expansion over the past several years, Yasho Industries’ operating profits have increased significantly, from 15 crore to 111 crore in FY23. Similarly, the net profits have also shown consistent growth, from 0 to 64 crore during the same period. The company’s profitability has improved with Return on Capital (RoC) increasing from low teens to mid-20s. The latest RoC stands at 22%.

However, there are a couple of concerns to be aware of. Firstly, the inventory days have increased compared to the previous year, which could pose a risk. Secondly, the company has a higher debt-to-equity ratio of 1.37, which is on the higher side. On the positive side, the company has consistently generated positive cash flow from operations.

The Leadership

Moving on to leadership, Yasho Industries was founded by Mr. Vinod Javeri in 1985. It is currently run by the second-generation leader, Mr. Parag Javeri, who serves as the Managing Director. He holds a Masters of Science degree in organic chemistry and has been associated with the company for over 30 years. Mr. Yash Javeri, the younger brother, serves as the Director and CFO of the company. He holds a Bachelor’s degree in Commerce and has been associated with the company for over 25 years.

The leadership team brings a wealth of experience to the table. Now, let’s discuss the future growth prospects of the company. The Indian chemical sector, especially specialty chemicals, has tremendous growth potential due to factors such as low-cost labor, skilled talent availability, resources like land and electricity at cheaper rates, and the “China Plus One” strategy.

The rising consumption within the Indian economy further fuels this growth.

Company’s Expansion

One way to gauge future growth is by looking at a company’s capacity expansion plans. Yasho Industries has an ambitious plan for capacity expansion in FY24. They have started a Greenfield project at Panchmahal in Gujarat, with a capacity of 17,000 metric tons per annum.

This new facility would be even bigger than the combined capacity of their existing facilities. The estimated cost for phase one of this expansion is 400 crore rupees, and it would focus on industrial chemicals with an EBITDA margin higher than 20%. This expansion plan indicates ample growth opportunities, and an increase in capacity would ultimately result in revenue and profit growth.

The production is expected to commence in Q4 of FY24. The estimated revenue from phase one is projected to be 550 to 600 crore, which is almost double the revenue of the entire FY23. The funding for this expansion includes 269 crore from banks and 131 crore from internal accruals.

It’s worth noting that even after the addition of 17,000 metric tons per annum, phase one would only utilize 50-55% of the newly acquired 42-acre land, leaving room for further expansion. This new facility would not only significantly increase revenue but also boost EBITDA and net profit. The future looks promising for Yasho Industries.

Moat

In terms of the company’s moat, there are high entry barriers in the sector due to the complex processes and technologies involved, making it difficult for new entrants. Additionally, there is a long gestation period between investment in R&D and commercialization of new products.

Furthermore, strict regulations regarding environmental compliance act as strong entry barriers. Yasho Industries has nearly four decades of experience in the business and maintains strong relationships with top companies worldwide. The company’s focus on innovation to bring new products and stay ahead of industry trends solidifies its moat.

Now, let’s consider the key risks associated with investing in Yasho Industries. Firstly, there is an environmental concern in the chemical sector, which always carries the risk of environmental damage and stricter regulations.

Secondly, input costs, including electricity and gas prices, can be volatile, which affects the chemical sector, along with fluctuations in raw material prices that impact margins. Thirdly, the company’s higher debt and increased inventory levels for the new plant expansion pose risks that need to be managed effectively.

Lastly, competition is a significant risk, especially from established players in rubber chemicals, aroma chemicals, and specialty chemicals. Chinese players still dominate the sector. Competition can impact the company’s margins.

Shareholding Pattern

In terms of shareholding pattern, promoters hold a 71.54% stake, and the remaining is with the public. Ace investor Mr. Ashish Kacholia made an entry in December 2021 and has consistently increased his stake to the current level of 3.99%. The share price movement of Yasho Industries since its IPO in 2018 has seen fluctuations, ranging from around 100 to 2000.

After a correction, the stock has recently been trading at around 1650, with a P/E ratio of 29 and a market cap of approximately 1850 crore.

Considering the future growth prospects and the company’s solid financials, Yasho Industries appears to be an attractive investment opportunity. It is a leading player in the fine and specialty chemical segment with a strong track record and leadership.

Conclusion

The company’s capacity expansion plans in FY24, with a focus on rubber chemicals, lubricants, and specialty chemicals, are expected to drive further growth and margin expansion. The company’s strong moat, with high entry barriers and relationships with top clients, adds to its appeal.

Furthermore, the company’s reasonable P/E ratio of 29, compared to other chemical companies, makes it an interesting investment option. However, it’s essential to conduct thorough research and consider alternative investment options before making any investment decisions.

Disclaimer: The views expressed in this blog are for educational purposes only. This is not professional advice. Consult your financial advisor before investing.